The Single Strategy To Use For Bank

Wiki Article

The Best Strategy To Use For Bank Certificate

Table of ContentsAn Unbiased View of Bank Account Number7 Simple Techniques For Bank AccountHow Bank Certificate can Save You Time, Stress, and Money.The Definitive Guide for Bank DefinitionSome Known Facts About Bank Definition.

When a bank is perceivedrightly or wronglyto have problems, customers, being afraid that they could lose their down payments, might withdraw their funds so fast that the small section of liquid assets a bank holds becomes quickly exhausted. Throughout such a "run on down payments" a financial institution might have to sell other longer-term and also much less fluid possessions, typically muddle-headed, to fulfill the withdrawal demands.

Regulators have wide powers to interfere in struggling banks to decrease disruptions. Financial institutions are now required to hold more as well as higher-quality equityfor instance, in the form of preserved profits as well as paid-in capitalto buffer losses than they were prior to the economic dilemma.

The Best Strategy To Use For Bank

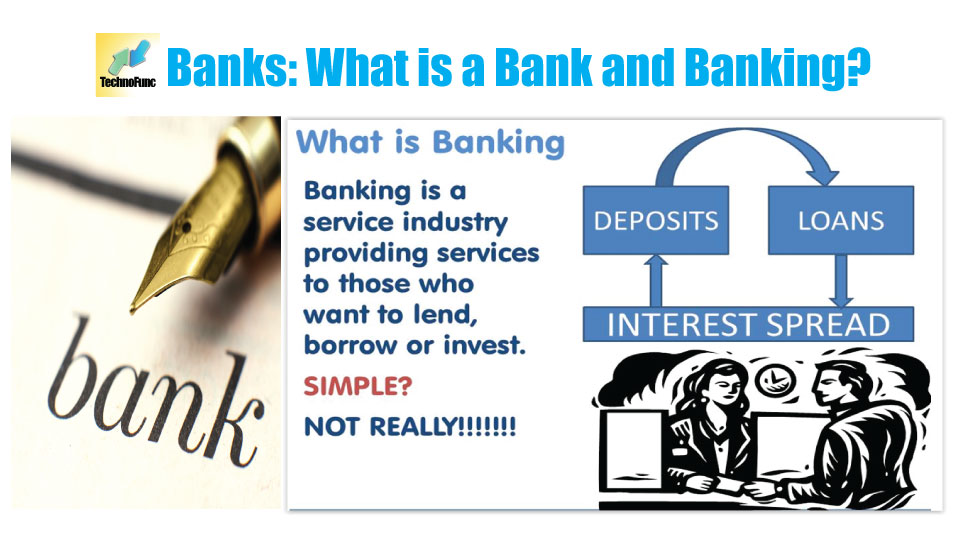

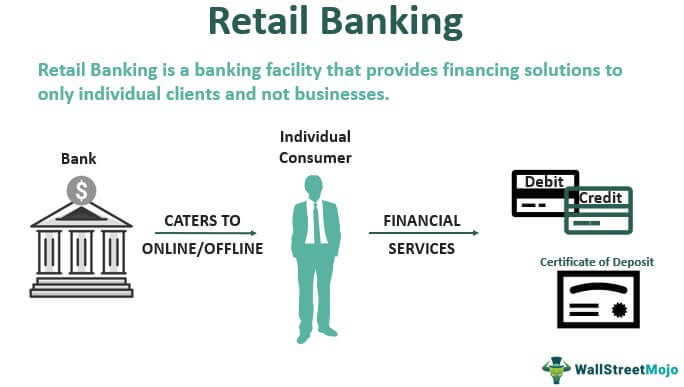

A bank is an economic organization authorized to supply solution choices for customers that wish to conserve, borrow or accrue more cash. Financial institutions typically approve deposits from, and deal financings to, their clients. They might likewise supply check- cashing or providing services, credit rating or debit cards, as well as insurance coverage alternatives. Financial institutions are not the only place where you can look for monetary services; check-cashing services Can help you get funds without a bank inspecting account.While financial institutions might supply comparable economic solutions as credit report unions, banks are for-profit businesses that direct most of their financial returns to their investors. That means that they are much less most likely to offer you the most effective feasible terms on a funding or an interest-bearing account. Think of a bank as the intermediary that takes care of and also enables a linked chain of interrelated economic activities.

Those borrowers then pay the funding back to the financial institution, with interest, over a set time (bank account). As the consumers settle their financings, the bank pays a fraction of the paid passion to its account holders for permitting it to utilize the transferred cash for issued lendings. To further your individual and company rate of interests, financial institutions offer a huge range of monetary solutions, each with its own positives and also negatives depending upon what your money inspirations are and just how they might evolve.

Not known Factual Statements About Banking

are savings products that also consist of checking account functions, like debit card transactions. are containers kept in a protected facility, like a safe-deposit box, where a crucial holder can position as well as get rid of useful items like jewelry or essential records. Banks are not one-size-fits-all procedures. Various kinds of customers will discover that some financial institutions are much better economic partners for their goals and also requirements than others.The Federal Get manages other banks based in the U.S., although it is not the only government company that does so. Area financial institutions have less assets due to the fact that they are unconnected to a major nationwide bank, but they offer financial solutions throughout a smaller geographical footprint, like an area or area.

On-line financial institutions do not have physical places however often tend to supply far better rate of interest rates on loans or accounts than banks with physical places. Transactions with these online-only organizations typically occur over a website or mobile application and also thus are best for someone that does not need in-person assistance as well as fits with doing a lot of their banking digitally.

What Does Bank Do?

(C) U.S. Bancorp (USB) Unless you prepare to stash your money under your bed mattress, you will ultimately require to connect with a financial institution that can guard your cash or concern you a car loan. While a financial company website institution might not be the establishment you ultimately pick for your monetary requirements, comprehending just how they run and also the solutions they can provide can assist you decide what to search for when making your visit here selection.Larger banks will likely have a collection of brick-and-mortar branches as well as ATMs in practical locations, in addition to many digital banking offerings. What's the difference between a bank and a lending institution? Due to the fact that financial institutions are for-profit establishments, they have a tendency to supply much less appealing terms for their consumers than a credit rating union might provide to make best use of returns for their investors.

a lengthy increased mass, esp of earth; mound; ridgea slope, as of a hillthe sloping side of any hollow in the ground, esp when surrounding a riverthe left financial institution of a river is on a viewer's left looking downstream an elevated section, rising to near the surface, of the bed of a sea, lake, or river (in combination) sandbank; mudbank the location around the mouth of the shaft of a mine the face of a body of orethe lateral inclination of an airplane about its longitudinal axis during a turn, Also called: banking, camber, cant, superelevation a bend on a roadway or on a train, athletics, biking, or other track having the outside developed greater than the inside in order to lower the effects of centrifugal force on vehicles, joggers, and so on, rounding it at speed and in some cases to help with drainagethe cushion of a billiard table. banking.

Bank Account Number Fundamentals Explained

You'll require to give a financial institution statement when you apply for a car loan, file taxes, or file for divorce. Filling Something is loading. A financial institution statement is a Related Site file that summarizes your account activity over a certain amount of time. A "statement duration" is commonly one month, however maybe one quarter sometimes.

Report this wiki page